Wallstreetpepe is one of the latest meme tokens stirring buzz in the crypto community. Promising viral appeal and rapid gains, it draws in investors eager to capitalize on meme coin trends. However, this project raises serious concerns due to its lack of transparency and questionable tokenomics, placing investors at risk.

In this detailed review, we analyze Wallstreetpepe’s background, the controversies surrounding it, potential risks, and how investors can protect themselves. If you have already suffered losses from Wallstreetpepe or similar projects, Lostcoinrescue.com offers trusted crypto asset recovery services to help you reclaim your funds.

What Is Wallstreetpepe?

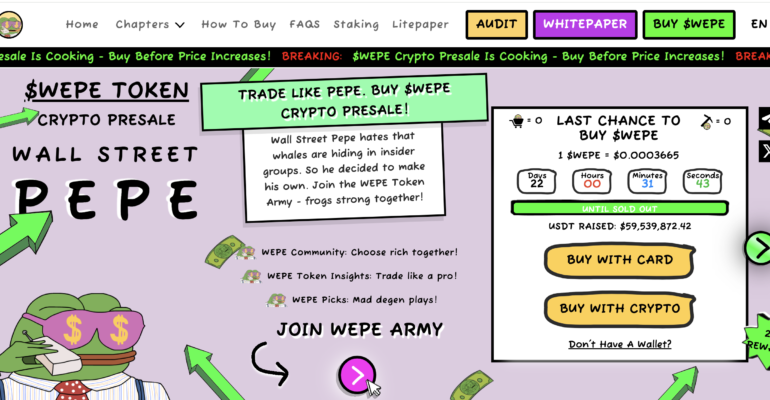

Wallstreetpepe markets itself as a community-driven meme cryptocurrency blending internet culture with decentralized finance. Its goal is to engage retail investors through viral marketing and social media hype. While the concept aligns with other successful meme coins, Wallstreetpepe remains unproven, with a newly launched presence and limited public information.

Key Concerns and Red Flags

1. Lack of Transparency

Wallstreetpepe’s developers remain anonymous, with no verifiable information about their experience or intentions. This anonymity makes it difficult for investors to trust the project or seek accountability in cases of wrongdoing.

2. Tokenomics and Market Risks

Issues noted by the crypto community include:

- High transaction fees that discourage trading.

- Unclear liquidity pool status, which may increase the risk of sudden liquidity withdrawal (“rug pull”).

- Uneven token distribution, favoring early insiders and increasing market manipulation risks.

3. Exposure to Pump-and-Dump Schemes

The token’s hype-driven growth could attract market manipulators who artificially inflate prices before selling off their holdings, leaving retail investors at a loss.

Community & Social Media Buzz

Wallstreetpepe benefits from a lively online community, but this often results in speculative investment behavior rather than sustainable growth. While social media engagement can boost adoption, it also intensifies price volatility and risks.

How to Stay Safe

Investing in projects like Wallstreetpepe requires vigilance:

- Research thoroughly: Verify team credentials, project goals, and tokenomics.

- Invest cautiously: Never commit more than you can afford to lose.

- Watch for red flags: Lack of transparency and negative reviews signal caution.

- Use reputable platforms: Trade only on trusted exchanges and wallets.

Lost Funds? How Lostcoinrescue.com Can Help

If you have already fallen victim to Wallstreetpepe or other crypto scams, don’t despair. Lostcoinrescue.com specializes in recovering stolen crypto assets through blockchain forensic analysis, legal consultation, and collaboration with authorities.

Our experienced team works tirelessly to help victims regain their funds and hold scammers accountable. Visit Lostcoinrescue.com today to learn more about our recovery services and how we can assist you.

Final Thoughts

Wallstreetpepe is a controversial and high-risk meme token with several red flags. While it may appeal to speculative traders, its anonymity, unclear tokenomics, and volatility make it unsuitable for risk-averse investors.

Always conduct your own research and stay informed before investing in any crypto project. And if you’ve suffered losses, remember that professional help is available through Lostcoinrescue.com.